As a result of the “PATH Act,” there were changes on withholding under Foreign Investor in Real Property Tax Act (FIRPTA) that went in to effect for transactions closing on and after February 16.

Summary of changes to withholding:

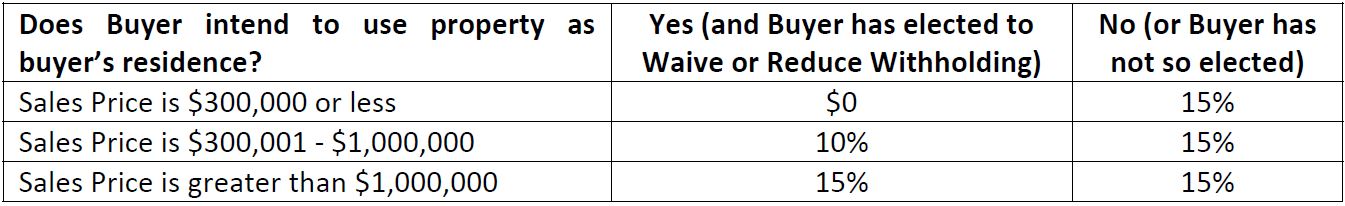

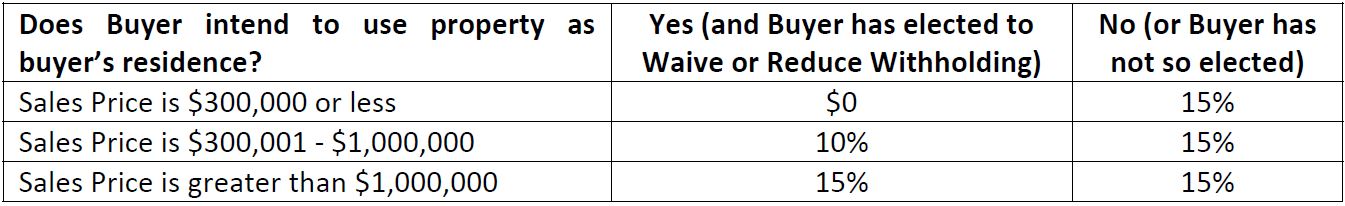

1. Increase to 15%: Unless an exemption or reduced rate applies, the withholding amount has

been increased from ten percent (10%) to fifteen percent (15%) of the sales price.2

2. Personal Residence Exemption: If both of the following conditions are met:

a. the buyer is acquiring property that will be used as the buyer’s residence, and

b. the sales price is $300,000 or less, then the buyer may elect to waive withholding under Section 1445(b)(5) of the Tax Code. This exemption and the requirements for same are unchanged from the current law.

3. Reduced Rate of Withholding: If both of the following conditions are met:

a. the buyer is acquiring property that will be used as the buyer’s residence, and

b. the sales price is greater than $300,000, but not more than $1,000,000, then the buyer may elect to withhold a reduced withholding amount equal to ten percent (10%) of the sales price rather than the unreduced rate of fifteen percent (15%).

This graph should help:

The responsibility and liability to the IRS with respect to FIRPTA withholding rest with the buyer – not the settlement agent or the transferor. As such, the buyer is not required to make this election, even if the facts may support an exemption or reduced rate.

Neither the exemption nor the reduced rate automatically applies. Instead, if the buyer opts to invoke the exemption or reduced rate, the buyer must make an affirmative election to do so.

In order to qualify for the exemption or the reduced rate, the buyer or a member of the buyer’s family must reside at the property for at least 50% of the number of days the property is occupied by any person during each of the two 12‐month periods following the date of closing. If the buyer fails to meet the occupancy requirements, the buyer may become liable to the IRS for the difference between the amount that was actually withheld, if any, and the amount that should have been withheld, plus interest and penalties.

To ensure proper documentation, the buyer will need to supply specific written direction to waive the withholding or withhold the reduced rate. We’ll help you through that process.

You can get a PDF of this Title Tip here.

A CDD is a Community Development District assessment. Tunities vi

A CDD is a Community Development District assessment. Tunities vi